We’ve followed book printing for well over a decade—well before Amazon and e-books began shaking things up like no tomorrow. E-books grew at a breathtaking pace for a number of years, and not too long ago, some pundits were breathlessly predicting they would constitute half or more of publishers’ revenue within five years. In 2013, however, e-book growth slowed considerably, and in some sectors, it contracted. According to AAP, e-books accounted for about 21% of trade sales last year, down from 23% the previous year. While still growing, e-books clearly will not decimate printed books, but will continue to erode volume and forge changes in the market.

Pew surveys find that 87% of e-book readers also read a printed book during the year; 52% of readers only read printed books, and only 4% read e-books exclusively. This recognition has spawned a number of partnerships among authors and publishers for print-only and other arrangements that bundle print, e-book and audio formats.

Pew surveys find that 87% of e-book readers also read a printed book during the year; 52% of readers only read printed books, and only 4% read e-books exclusively. This recognition has spawned a number of partnerships among authors and publishers for print-only and other arrangements that bundle print, e-book and audio formats.

MORE: The Door Is Opening for Digital Printing in the Newspaper and Magazine Markets

The market for printed books has contracted, however, and this will continue. Consolidation is ongoing among publishers, retailers, printers and suppliers. Excess manufacturing capacity constrains prices, making book printing an even tougher environment for printers. Publishers continue to chip away at waste in the supply chain, aided in no small part by high-speed inkjet printing. Most of the printers INTERQUEST surveyed in its most recent study of the book market report an increase in the use of automated inventory replenishment systems. Run lengths overall are still declining, leaving book printers faced with an increasing number of fast turnaround orders, which places a premium on automation and efficiency.

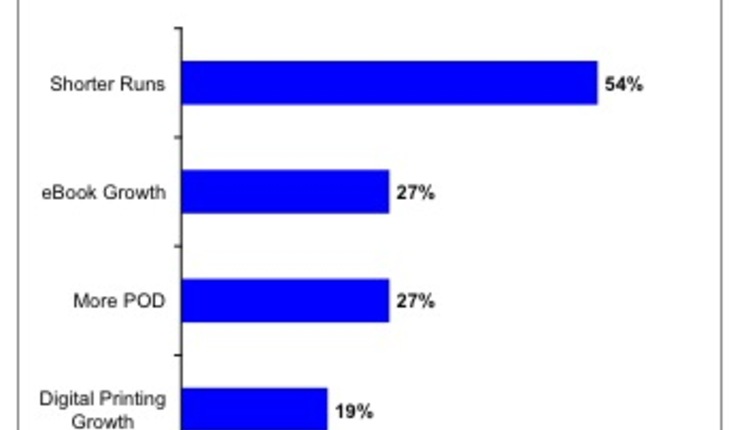

The leading market trends cited by the book publishers we surveyed are: the growth of e-books, cited by 59% of the respondents; shorter print runs, noted by slightly more than half (52%) of the respondents; and an increase in the use of short-run digital printing, cited by 45% of the respondents. Not surprisingly, formulating an effective multi-media/multi-channel strategy is their leading concern, cited by nearly two-thirds of the publishers.

Among the book printers we surveyed, half indicates that the leading trend they see in the market is the use of automated inventory replenishment programs; about 42% say that print runs are shorter, and one-third point to an overall decline in the volume of printed books. About one-quarter of the printers note an increase in the use of digital printing. Digital printing equipment was, in fact, the most commonly cited equipment acquisition over the 18 months prior to the survey.

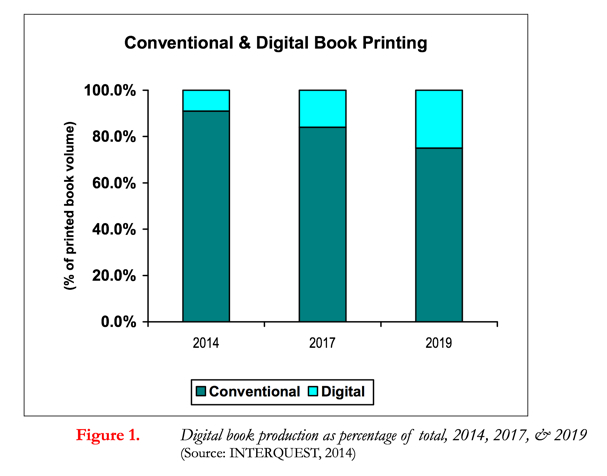

INTERQUEST forecasts that the number of conventionally printed books will decline by about nine percent per year over the next five years, while the number of digitally printed books grows at an annual rate of about 15%. Black-and-white digital output will increase at an annual pace of about 12.7%, while color grows at a faster 17.5% annual rate. Inkjet will continue to increase its share of the digital book printing market over the period.

For more information, contact INTERQUEST at 434-979-9945 or visit www.inter-quest.com.