©2017 DOCUMENT Strategy Media

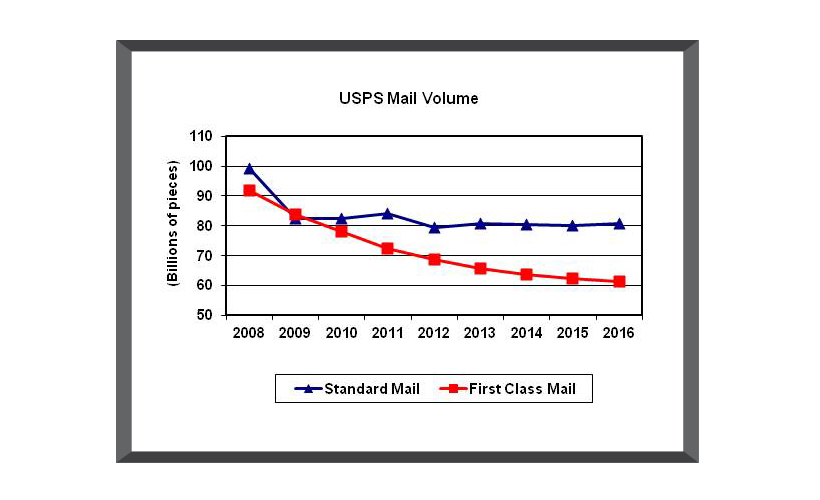

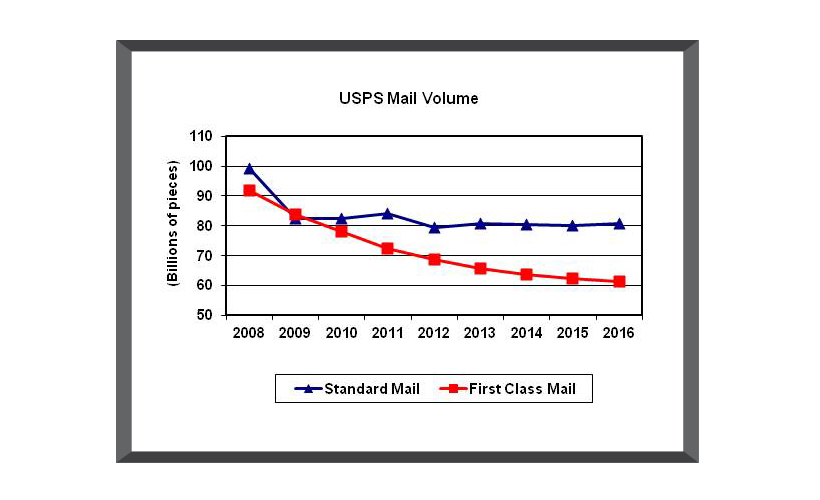

Although direct mail volume will probably never return to pre-recession levels, from 2013 to 2016, direct mail volume stabilized. Over the same period, transactional mail (mainly bills and statements) continued to decline, though, at a lower rate of 2.4% per year. Direct mail remains an important tool for businesses to reach new and existing customers and a pivotal application for the USPS and for a broad sector of the printing industry.

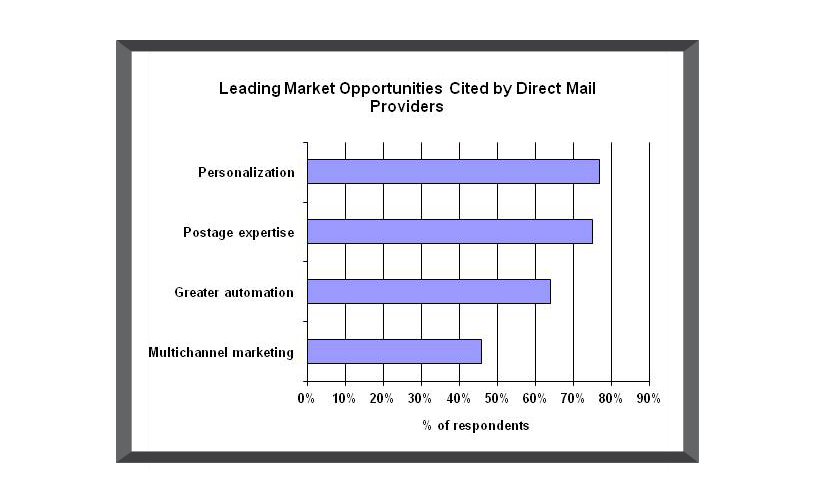

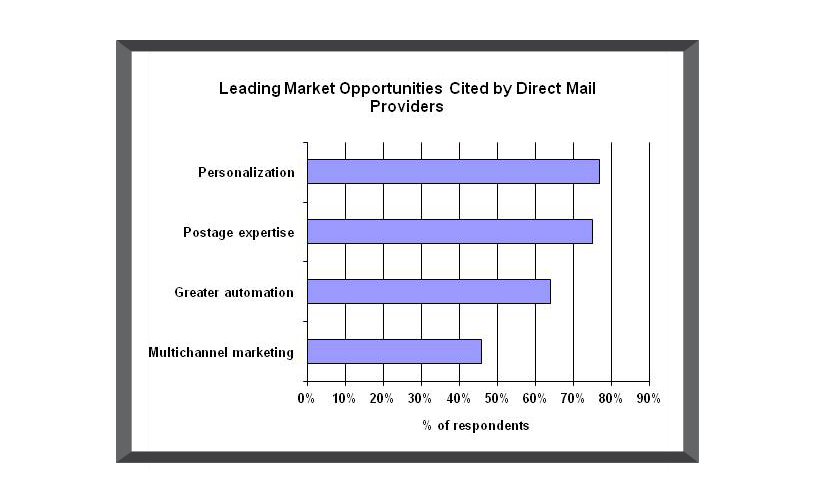

Personalization, postage expertise, and greater automation are viewed by providers as their best business opportunities. About half of the providers surveyed see multi-channel communication as an important trend, and the same percentage say they provide integrated campaign services. Overall, most see direct mail complementing digital marketing over the coming years.

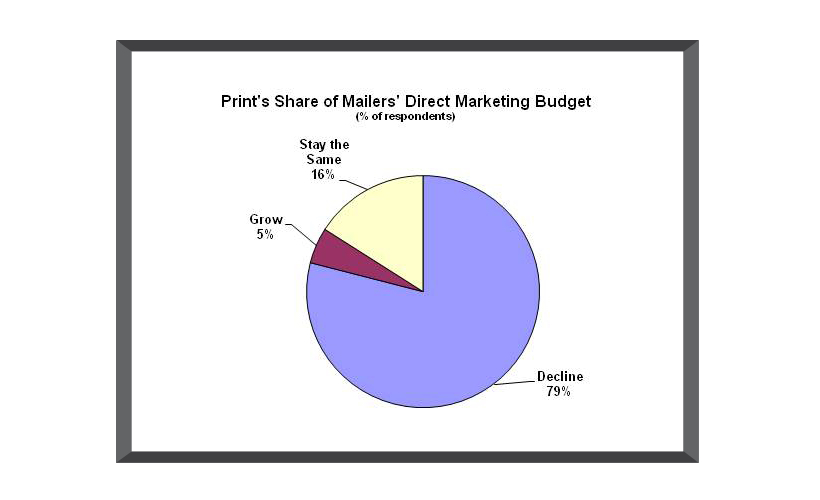

Direct mail maintains a prominent share of the direct marketing budget for the vast majority of mailers interviewed. Although many mailers acknowledge that more of their direct marketing dollars are being allocated to online and mobile channels, these companies remain highly committed to direct mail. Yet, mailers must now stretch direct marketing dollars across traditional and digital channels while, at the same time, mitigating the impact of steadily rising postage costs on the direct mail they send.

According to the Winterberry Group, US direct mail spending increased by 3.1% annually from 2013 to 2015, as some returned to printed communications versus electronic alternatives. Although printers are historically overly optimistic, the direct mail providers interviewed by INTERQUEST are generally upbeat with their direct mail volume projections for the next few years—nearly 80% believe it will increase at an average annual growth of four percent to five percent.

Figure 1. USPS Mail Volume Growth, 2008-2016

Source: The United States Postal Service (USPS)

A number of companies are involved in producing and delivering direct mail. These include ad agencies and design firms, list providers and data analytics companies, and various print and mail providers. INTERQUEST estimates that commercial printers and specialized direct mail printers produce about three-quarters of the total North American direct mail print volume.

Direct mail is a proven, cost-effective method of getting messages into the hands of customers. Although it faces strong competition from other channels, it offers a number of significant advantages and remains a valuable ingredient in a multi-channel marketing mix. When asked about the benefits of using direct mail, direct marketing experts, direct mail providers, and mailers recently interviewed by INTERQUEST stress the following:

- It is tangible; it is something the recipient has in his/her hands; it stays around for a long time; it can be passed along to others; and it is a key element for branding.

- It helps drive the call to action more than a digital message.

- It is among the most readily tracked and measurable of all media.

- It is the highest conversion and response rate medium next to telemarketing.

The future of direct mail

Direct mail providers have a positive view of the current state and the future of direct mail. The vast majority anticipate growth in their direct mail volume over the next few years. They cite digital color printing, targeting and personalization, and industry consolidation as key market trends. Price pressure, postage cost increases, and the level of investment required to remain competitive are their toughest challenges.Personalization, postage expertise, and greater automation are viewed by providers as their best business opportunities. About half of the providers surveyed see multi-channel communication as an important trend, and the same percentage say they provide integrated campaign services. Overall, most see direct mail complementing digital marketing over the coming years.

Figure 2. Leading Market Opportunities Cited by Direct Mail Providers

Source: PRIMIR, “Trends and Future of Direct Mail Through 2020,” by INTERQUEST, Ltd., 2015

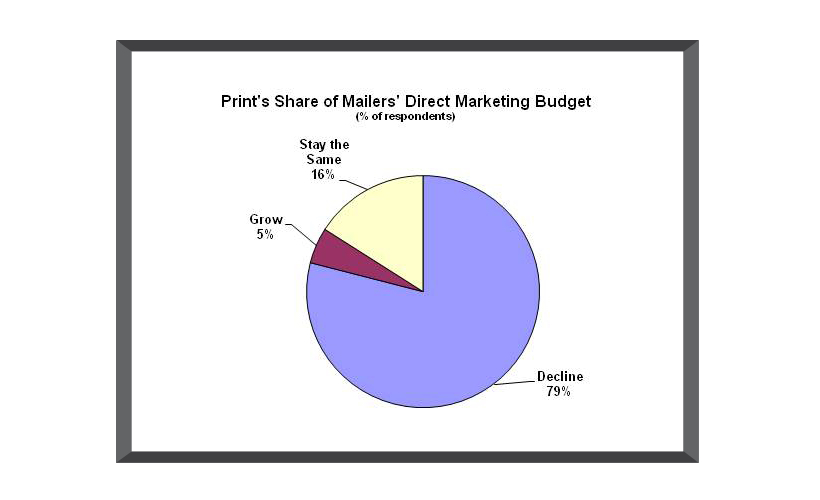

Direct mail maintains a prominent share of the direct marketing budget for the vast majority of mailers interviewed. Although many mailers acknowledge that more of their direct marketing dollars are being allocated to online and mobile channels, these companies remain highly committed to direct mail. Yet, mailers must now stretch direct marketing dollars across traditional and digital channels while, at the same time, mitigating the impact of steadily rising postage costs on the direct mail they send.

According to the Winterberry Group, US direct mail spending increased by 3.1% annually from 2013 to 2015, as some returned to printed communications versus electronic alternatives. Although printers are historically overly optimistic, the direct mail providers interviewed by INTERQUEST are generally upbeat with their direct mail volume projections for the next few years—nearly 80% believe it will increase at an average annual growth of four percent to five percent.

Figure 3. Print’s Share of Mailer’s Direct Marketing Budget

Source: PRIMIR, “Trends and Future of Direct Mail Through 2020,” by INTERQUEST, Ltd., 2015

Despite these encouraging signals, other considerations are cautionary. A number of surveys and projections find that direct mail is losing ground to electronic alternatives, such as email, social media, search, and mobile marketing. The vast majority (79%) of the mailers interviewed expect their print-based direct mail, as a percentage of their total direct marketing budget, to decline over the next few years. On average, print-based direct mail will decline from 57% to 51% of their overall direct marketing budget from 2015 to 2018.

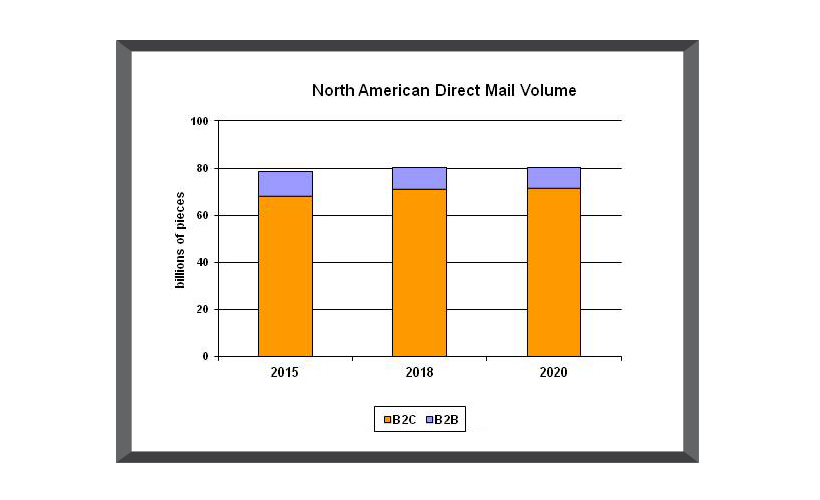

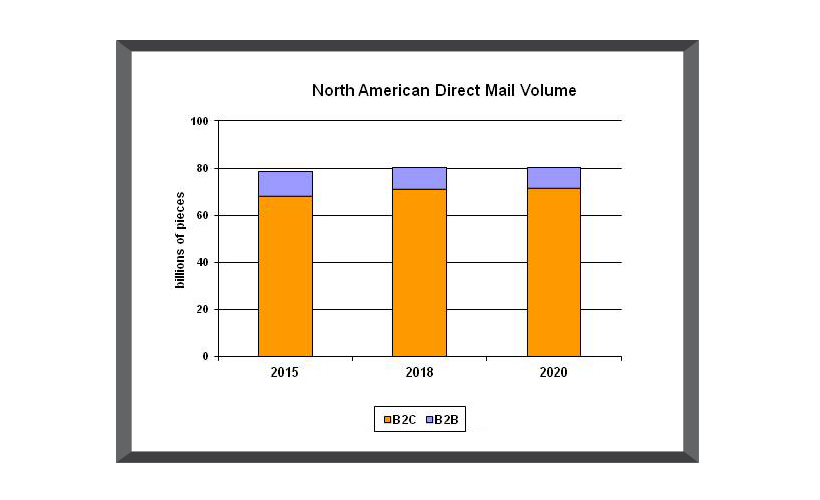

In weighing all of these factors, positive and negative, INTERQUEST projects that total direct mail volume (pieces) in North America will slightly increase by 0.4% from 2015 to 2020 as a result of relatively good economic growth and the continuing strengths of direct mail in the marketing mix.

What will 2020 bring for direct mail?

Figure 4. North American Direct Mail Volume, 2015-2020

Source: PRIMIR, “Trends and Future of Direct Mail Through 2020,” by INTERQUEST, Ltd. 2015

In weighing all of these factors, positive and negative, INTERQUEST projects that total direct mail volume (pieces) in North America will slightly increase by 0.4% from 2015 to 2020 as a result of relatively good economic growth and the continuing strengths of direct mail in the marketing mix.

Gilles Biscos is the Founder and President of INTERQUEST Ltd, a market and technology research and consulting firm in the field of digital printing and publishing. For more information on the “Trends and Future of Direct Mail Through 2020” study, visit www.inter-quest.com.