Shifts in consumer behaviors, business policies, technologies and services have driven sustained changes within the presentment and payment markets in the United States. This can be seen in the strong consumer desire for mobile apps, as well as an increasing comfort with transacting business online and via mobile technologies. At the same time, the industry is also seeing many business policy changes. A number of today’s businesses are now paperless by default at account inception, and some may even demand payment for printed versions of bills and statements. In an effort to stand out from the competition, businesses are also ramping up their marketing efforts. Technologies and services are changing too. The market has seen the emergence of digital mailbox services, advances in customer communications management (CCM), the expansion of mobile payment technologies/services and the introduction of cloud-based services. The focus is on preference management, and many businesses are wondering how to best support their customers’ transactional communication needs.

|

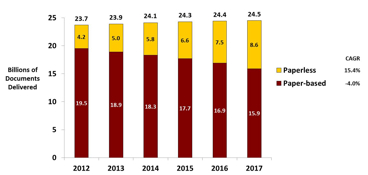

Figure 1: Market Sizing and Forecast for B2C Delivery of Bills and Statements (Volume) Click here to enlarge image. |

In today’s multi-channel world, having a proper understanding of the current landscape is paramount. As a result of five months of research, we expect that 8.6 billion bills and statements (35%) delivered to consumers in the US will be paperless in 2017. From a base of 4.2 billion (18%) in 2012, this represents a 15.4% compound annual growth rate (CAGR).

Growth in the paperless channel will be driven by:

- Increasing consumer comfort with digital-only communications

- Heavy marketing from bill and statement providers

- Better targeting of consumers who have electronic access but still receive the paper document

- Charging for paper-based communications and/or defaulting new customers to paperless

- New technology and services, such as preference management and consolidation services

At the same time, we expect nearly two-thirds (65%) of bills and statements delivered to consumer households to be paper-based in 2017. This rate of decline will be influenced by:

- Consumer inertia–lack of strong motivators to change

- Insufficient provider investment in the necessary technology, partnerships and resources

- Lack of consumer familiarity with alternative delivery options (e.g., consolidators)

- A continued preference for paper-based communications

- A subset of consumers who lack consistent access to the Internet

Additional layers to this forecast include our expectations for how the multi-channel transactional communications market will evolve. The first is the primary source of consumer interaction (provider or consolidator), and the second is the primary consumer access point (physical mail, the web, mobile apps and email attachments). These changing dynamics strongly support the need for bill and statement providers to have a defined strategy around the consolidator channel, mobile apps and responsive web design to account for the variety of media through which consumers are accessing web content—from mobile phones to smart TVs.

|

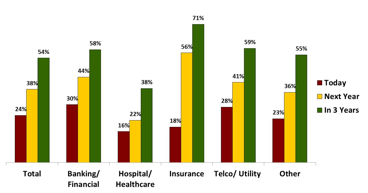

Figure 2: Aggressive Provider Expectations for Consumer Adoption of Paperless Delivery Click here to enlarge image. |

Our business respondents cited cost reduction as their top priority for customer communications over the next 12 to 24 months, influencing their very aggressive expectations for consumer adoption of paperless delivery. For instance, our insurance respondents expect paperless delivery adoption among their customers to grow from 18% today to 71% within three years.

Business respondents have been similarly aggressive in previous surveys, exposing one of the reasons why we have seen less focus on improving paper-based communications: Bill and statement providers are choosing to invest in driving paperless initiatives in the hopes that the paper will just go away. This is an incomplete communications strategy. In fact, our research revealed that consumers are very clear on how they want their providers to improve the business communications they receive in the mail and electronically:

- Make them easier to understand

- Personalize the content

- Use color to emphasize important information

This speaks to the importance of optimizing every communication to not only help improve customer satisfaction but also to reduce call center volume. More than 85% of consumers will call customer support if they have a question about a bill or statement—a costly alternative to providers sending clear communications from the start. The future of transactional communications will continue to have a substantial paper-based component; however, as transactional communications become increasingly interactive and consumers demand access via a broader set of channels, bill and statement providers will need to adapt to support the breadth of their customer needs. Invest in the appropriate technology or seek an external provider who has already completed the integrations and made the necessary investments.

Tweet